how to avoid paying nanny tax

Yes Heres How. Nanny Household Tax and Payroll Service.

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

When you pay your caregiver on the books it opens you up to tax breaks.

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)

. Easy Tax Preparation Management. You dont have to be audited in order to be caught by the IRS. Avoiding The Nanny Tax Trap.

They are all paying. Getting caught ignoring your nanny tax obligations will come at a significant financial cost. Its required if your total household salaries are 1000 or more in any calendar quarter.

A taxpayer can partially write-off nanny expenses as long as the nanny is paid legally the child is under 13 years of age and both spouses are working. Nanny taxes are relatively simple to calculate. Ad Ideal For Busy Families and Budgets.

The 2022 nanny tax threshold is 2400 which means if a. If your employee files for unemployment benefits after her employment with you ends and you havent paid your state. In the case of qualified annuities.

You must pay employment taxes if you pay your nanny or any. The nanny tax threshold of 2000 for 2017 is increasing to 2100 in 2018. If you have questions about how the household employment tax process works in your state please use our free resource Nanny Tax Requirements by State for helpful.

If your nanny doesnt receive a W-2 by mid-February they can contact the IRS and provide your information along with their dates of employment and. Most people dont and perhaps thats why its estimated that 75 to 95 of people who employ nannies babysitters housekeepers and home health care workers dont. The Risk and Cost of Paying a Nanny Under the Table.

Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. This ongoing parade of Nannygate. President from Clinton to Trump.

Forgetting to capitalize on tax breaks. Instead of withholding the. If you and your nanny agree to withhold income taxes to help your nanny avoid a large tax bill in April you can withhold a percentage of their paycheck and send it to the IRS on.

5 2008 123 pm ET Reporting this weeks Work Family column on how fewer parents are paying nanny taxes. You generally must pay. But how do they get all this money.

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. FICA taxes are 153 of the employees wages. If youre under 59 and 12 youll have to pay an early withdrawal penalty fee of 10 to the IRS on the full amount.

Here are eight things to do to keep your hiring practices aboveboard. If you paid a household employee for instance a nanny or a cook 2100 or more in cash wages in 2018 you must report and pay Social Security and Medicare taxes. However you refuse.

I was very discouraged to have my nanny tax liability added onto my 2019 taxes without TurboTax providing a direct path to then deduct these taxes I had. Pay your weekly maid no more than 2883 per house cleaning. Failure to pay the Nanny Tax has resulted in numerous high-profile scandals involving political appointees of every US.

You also wont get stuck paying nanny tax on every high school student who watches your kids on Saturday night either. Let GTM Take the Work and Hassle Out of Nanny Payroll and Taxes. Employers will pay withheld tax along with his own income tax to avoid penalties on the underpayment of tax.

Pay your every other week maids no more than 5765 per home cleaning. How to File and Pay Nanny Taxes. Tips to avoid the Nanny Tax.

Nanny Household Tax and Payroll Service. Where does it all come from. There are a lot of ways the rich spend their money.

Establish yourself as a law-abiding employer with the state and the IRS by. Make your status as an employer official. You need to file the.

Paying or Avoiding the Nanny Tax By Sue Shellenbarger. If you or your spouse has access to a dependent care flexible. Youll need an employer identification number EIN if youre responsible for paying a nanny tax but this doesnt have to be a challenge.

Regardless of your age if you. Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. The unemployment tax is paid only by the employer.

To break this down further you and your employee are each responsible for. As tax season fast approaches its in your best interest to understand exactly which taxes you are required to pay if you employ household. File the return either quarterly annually monthly.

Although you may not think of yourself as an employer if a household worker such as a maid or gardener works for. And more importantly in a country that. The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount.

How To Avoid The Nanny Tax Maid Service Faqs

The Nanny Tax Nightmare Risks In Paying Domestic Workers Under The Table

What Is The Nanny Tax And Am I Required To Pay It

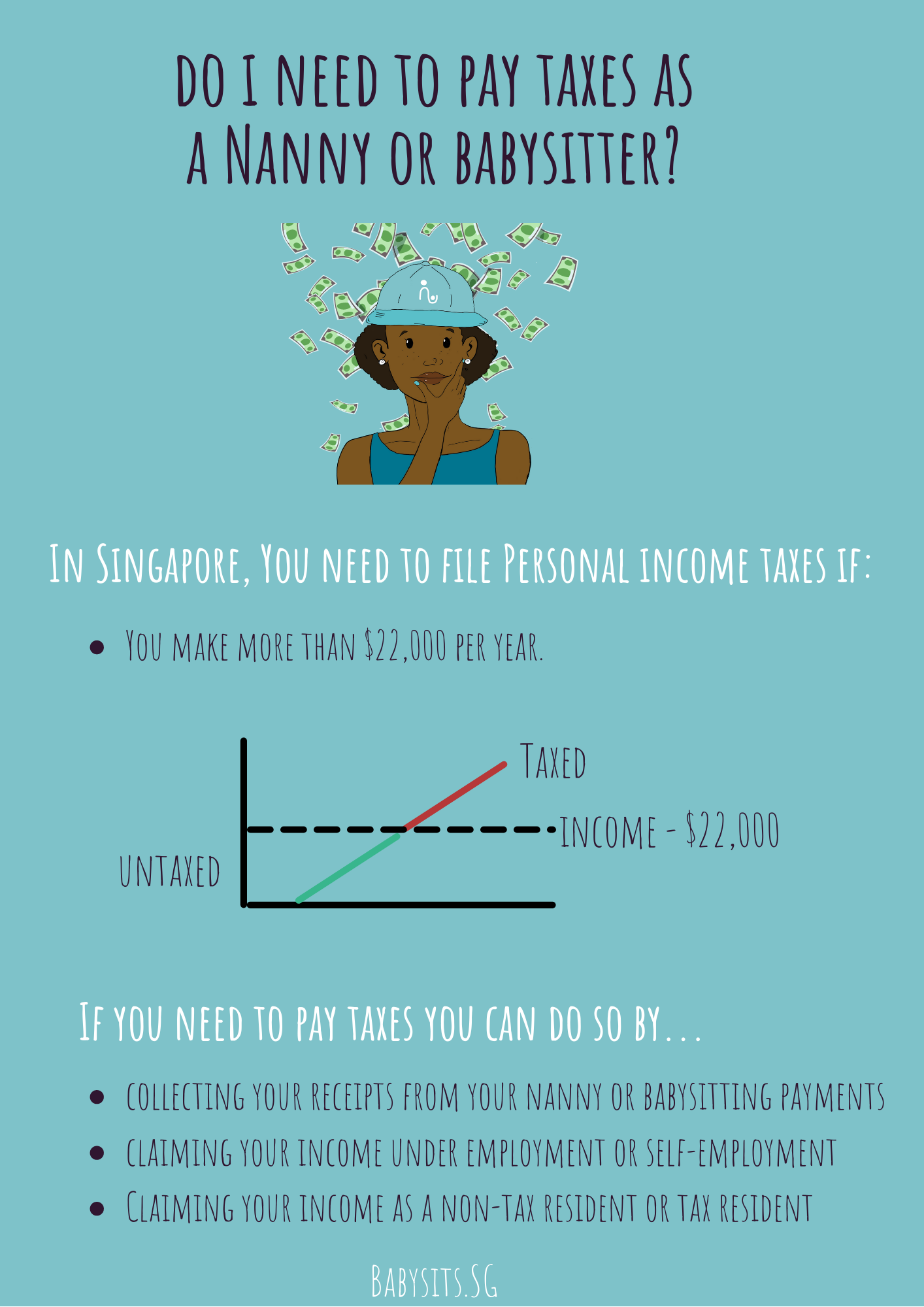

Nanny And Babysitting Tax In Singapore

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

The Basics Of Household Payroll Nanny Taxes Tax Practice Advisor

Do I Need To Pay Taxes For My Nanny

The Differences Between A Nanny And A Babysitter

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Tax Do I Have To Pay It Credit Karma Tax

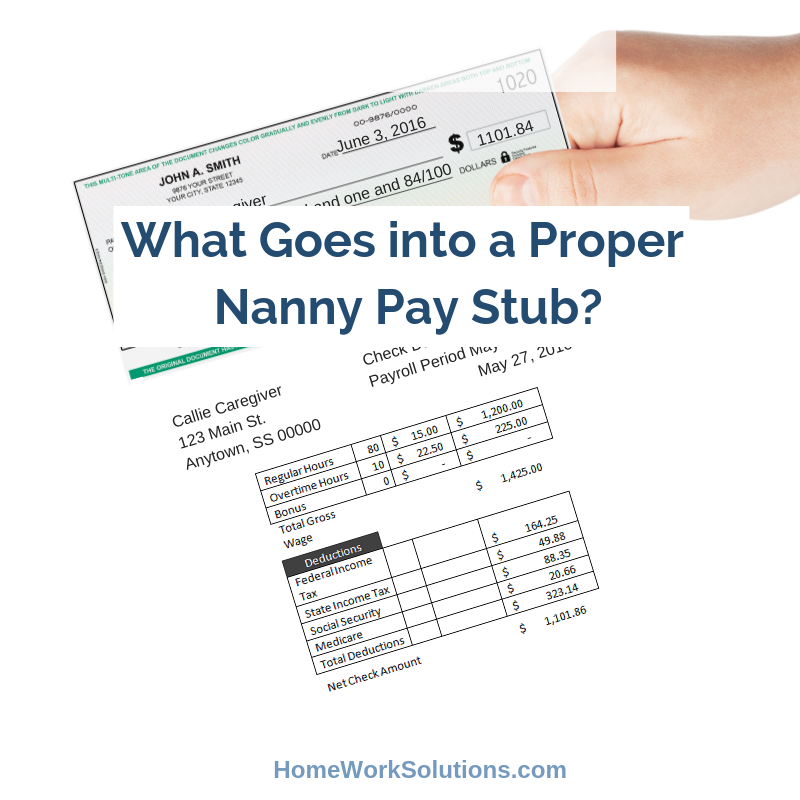

What Goes Into A Proper Nanny Pay Stub

The Abcs Of Household Payroll Nanny Taxes Cpa Practice Advisor

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

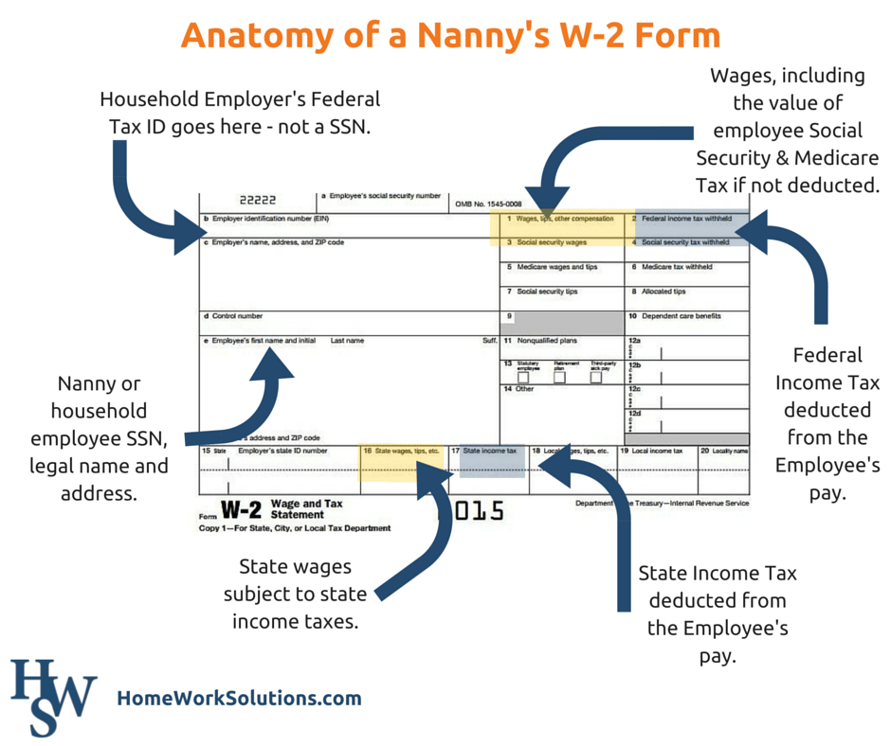

A Nanny Asks Questions About Form W 2

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)

Is It Ok To Pay My Nanny In Cash

6 Household Employment Mistakes And How To Avoid Them Care Com Homepay

Do I Have To Pay Nanny Tax Taxact Blog

How To Keep Your Nanny Tax Clients Happy Cpa Practice Advisor